The Great Financial Crisis of 2008 is by no means the first such event, as collapses and depressions in companies, businesses, industries – even countries and effecting the world – have occurred at almost regular intervals throughout history. The difference now is that such financial disasters are covered in depth almost instantly, and certainly graphically, by the media, and the sums of money involved appear ever more enormous and the effects often even more wide-ranging.

However, there have been many such calamities on a personal, and /or singular basis which bear mentioning, where decisions made, or in some cases not made at all, have been seen to be huge mistakes, sometimes because of lack of experience which can seldom be bought, and of course with the wisdom of hindsight. In some cases the specific monetary loss is impossible to evaluate, since popular TV shows also draw increased advertising revenue, but the red faces of some decision makers can well be imagined – perhaps as they were shown the door!

Following in chronological order is a list of 15 of the worst business decisions of the last 150 years, most of them far more recent than that, and identifying that not only do you need to know your business, but also that you are able to recognize where the business or industry is headed, work out the best way of getting there, and in particular stay ahead of the competitive field, especially when the pace of IT research and development is proceeding at such a pace and effecting almost everyone in today’s world.

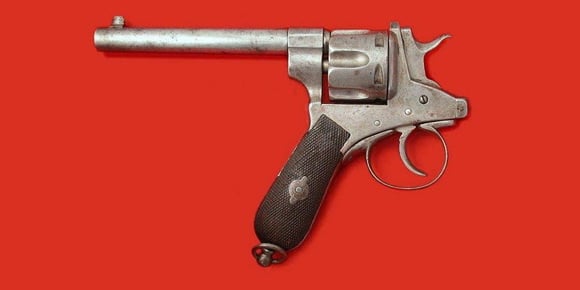

Edwin Drake – Oil drill patent

[divider]

[one_half]

[/one_half][one_half_last]

There must be some sympathy for Edwin Drake, a name you may not have seen before? He was employed by Seneca Oil in the late 1850s, initially to explore Pennsylvania for oil deposits, and then to try and invent a way of retrieving it from depths, as opposed to surface seepage. This he eventually did, by shoring the drilling shaft with a metal pipe to prevent earth collapsing into the bare shaft, a system still utilized to this day. However, not being a businessman, Drake didn’t realize the significance of his invention, and so failed to patent his oil drill, even though by this time he was continuing as an individual. He was eventually granted a stipend of $1,500 by Pennsylvania, but compared with what he might have had… oh dear!

[/one_half_last]

Western Union – The telephone system

[divider]

[one_half]

[/one_half][one_half_last]

In the 1870s, Western Union was so confident of their monopoly in the telegraph system that they didn’t see the need to invest in the growth – if any, in their opinion – of the telephone system. An offer of sale of his patent for $100,000 from Gardiner Greene Hubbard was rejected by president William Orton, and of course AT & T (an American multinational telecommunications corporation) subsequently became very rich from this drastic oversight!

[/one_half_last]

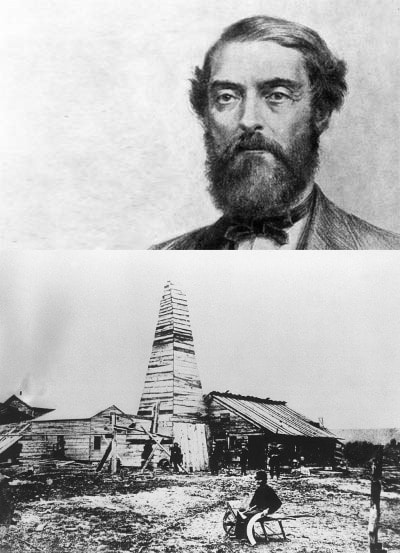

Decca Records – The Beatles

[divider]

[one_half]

[/one_half][one_half_last]

In 1961, the still relatively unknown Beatles were keen to find a record label, but Decca were less than impressed, especially with a group from Liverpool! Director Mike Smith preferred instead to sign London acts, maybe a more secure move, except that The Beatles became the best-selling band ever in world music, and revolutionized entertainment in the process; EMI (Electric and Musical Industries) signed the group, and rejoiced all the way to the bank!

[/one_half_last]

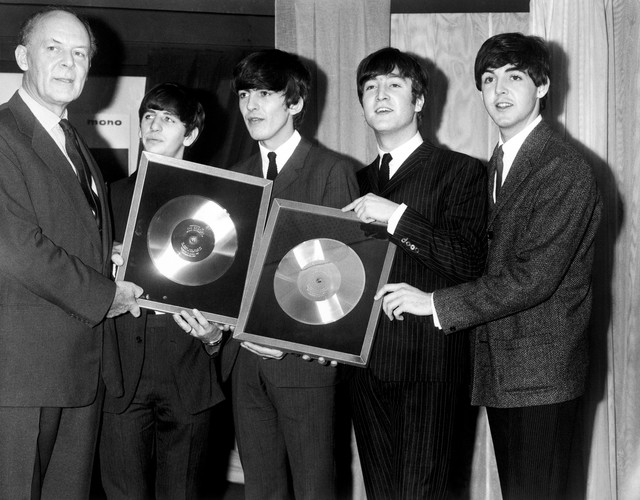

NBC and CBS – “Monday Night Football”

[divider]

[one_half]

[/one_half][one_half_last]

With the legendary Howard Cosell in commentary, how could “Monday Night Football” fail to be a winner – well, neither NBC nor CBS were buying it, literally. In the 1960s, TV and sports entertainment were still developing, usually on a local basis or with news-type programs such as “The Wide World of Sports”. The NFL had only merged with the AFL in 1964, and was nowhere near as commanding an attraction as it is today, still second in popularity country-wide behind baseball. NBC and CBS preferred to stick with the tried and tested “Doris Day Show” and “Laugh-In” programs respectively, however, with ABC third in the rankings, president of sports Roone Arledge saw the potential of American football as a prime-time spectacle. Debuting in 1970, “Monday Night Football” is now the longest-running program on American TV, and consistently at the top of the rankings, a big coup for ABC. More importantly for advertising, young male viewers are firm watchers, a key demographic for advertisers. Now on ESPN, the Super Bowl is the most watched single program on TV in the US, with advertising costs set appropriately!

[/one_half_last]

Kodak – Digital

[divider]

[one_half]

[/one_half][one_half_last]

Despite Kodak’s corporate dominance in the 1970s, engineer Steve Sasson began experimenting with a charge-coupled device (CCD), eventually working out how to use it converting light into the digital language of 1s and 0s; the first digital camera was the result, producing a 100,000-pixel image. Although Kodak saw the potential and invested heavily in development, management were too conservative to take the plunge, forces within the company stalled the release of a digital camera, preferring to stick with their comfortably profitable film-and-paper product. Not until almost 20 years later did Kodak finally move to digital, far too late to match the competition. The inevitable happened – over the next 10 years, 50,000 employees were made redundant, and in 2012 the company founded in 1888 filed for Chapter 11 bankruptcy. Now it produces only printer cartridges and film for motion pictures.

[/one_half_last]

Ross Perot – Microsoft

[divider]

[one_half]

[/one_half][one_half_last]

Ross Perot is known as a (generally) successful US businessman, and a sometime politician, however, he has not been immune from making mistakes in both fields of endeavour. In 1979, his Electronic Data Systems company needed to acquire computer software, and looked at the possible acquisition of Microsoft, then valued by (23-year-old) Bill Gates at a minimum of $40 million, Although Perot’s company was valued at around $1 billion, he thought this was too expensive, however, he later admitted in an interview with the Seattle Times that this was “possibly the biggest business mistake I’ve ever made.” As often the case, easy to be wise after the fact.

[/one_half_last]

IBM – Microsoft

[divider]

[one_half]

[/one_half][one_half_last]

Microsoft has been smart and lucky twice; in 1980, IBM contracted Bill Gates for just $80,000 to develop an operating system, the result being PC-DOS. However, Microsoft was to retain the copyright, and subsequently the MS-DOS system was created by the company. This was such a gigantic step forward that Microsoft was able to dominate the computer software industry for the following 30 years, while IBM was … just OK!

[/one_half_last]

E.T. – M&Ms “colorful button-shaped candies”

[divider]

[one_half]

[/one_half][one_half_last]

Another example of hindsight proving invaluable – in fact of course it cannot be bought! – is the decision by Mars refusal to allow M&Ms to feature in the movie “E.T”. Although director Steven Spielberg had had an enormous success with “Jaws”, apparently in 1982 no-one thought that “E.T.” would become one of the most iconic movies in film history. Similarly, on-line streaming rapidly overtook videos. The result? Hershey’s Reese’s Pieces were used, free, in “E.T.”, but mutual advertising was agreed, and Rease’s Pieces are reputed to have tripled in sales in the first week of the film’s release. M&Ms eventually recovered a portion of the lost market share, but at what cost?

[/one_half_last]

ABC – The Cosby Show

[divider]

[one_half]

[/one_half][one_half_last]

Regardless of legal proceedings in 2016, “The Cosby Show” was top of the ratings on US TV for five seasons in the late 1980, ensuring that NBC was also in the network top spot. ABC – so quick to adopt the almost instantly popular “Monday Night Football” – had been given first refusal, but apparently president of entertainment Lewis Erlicht didn’t like the concept, and turned it down. Supposedly ‘you can’t win them all’, but what a chance gone begging.

[/one_half_last]

Coke – ‘New Coke’

[divider]

[one_half]

[/one_half][one_half_last]

The Coca-Cola company was founded in the 1880s, and 100 years later, ‘Coke’ had become the dominant soft drink world wide, and also a significant marketing tool. However, in an attempt to widen the drink’s popularity even further, in 1985 “New Coke” was introduced, apparently confusing many “Coke” drinkers. The distinct taste was one thing, but supposedly an emotional bond had been formed with adherents which was lost, and caused millions of nostalgic complaints to the company. Eventually the mistake was acknowledged – despite the fact that research showed a mild preference for the new product – and Coca-Cola Classic was released, ‘Classic’ supposedly referring to the original, genuine article. Sales lost in the intervening three months are incalculable.

[/one_half_last]

Excite – Google

[divider]

[one_half]

[/one_half][one_half_last]

Although, back in 1999, Google was still based on largely unproven algorithms, even today Excite still categorises the internet by subject, and posts the weather as well as the news. No wonder it is now a subsidiary of Ask.com. Conversely, if Excite had seen the real worth, value, potential of Google back then, it would now be valued somewhere in the region of $350-400 billion. Instead, the offer by start-up kids Larry Page and Sergey Brin to sell their company to Excite for $1 million – later reduced to $750,000 – was almost totally ignored by the Excite board. The title of the company certainly doesn’t reflect the actions it has taken over the last 20 years.

[/one_half_last]

Blockbuster – Netflix

[divider]

[one_half]

[/one_half][one_half_last]

In the 1990s, Blockbuster had almost 10,000 stores, and revenue was close to $6 billion a year, quite a percentage earned from late returns! Efficient use of computers to ensure stores had ‘the latest’ and most popular movies. blinded executives to the growing influence of Netflix with its DVD-by-mail service. So much so that in 2000 when Netflix offered a joint venture to Blockbusters for $50 million based on their growing business, CEO John Antioco literally waved them away. Subsequently Netflix subscription and delivery service became so popular, that as of early 2016 it is valued at almost $25 billion. Blockbuster? It closed its last store and its attempted service a la Netflix in 2013, having filed for bankruptcy in 2010. If only ….

[/one_half_last]

The AOL – Time Warner Merger

[divider]

[one_half]

[/one_half][one_half_last]

Having grown with the fledgling internet to command 35 million dial-up subscribers in the US by 2002, AOL was looking to flex its financial muscles. However, nothing is guaranteed in the business world – although money can still ‘talk’ – and AOL’s decision through CEO Steve Case to merge with Time Warner in an agreement with CEO Gerald M. Levin in 2000, was both ill-timed and ill-advised. The amalgamation of new with old media – at $350 billion the largest in the business world at that time – was decidedly lop-sided: as the majority shareholder, AOL needed to perform, in particular by attracting advertising revenue. Unfortunately, what is now referred to as ‘the dot-com bubble’ burst, internet stocks fell alarmingly wiping $100 billion off the merged value, and on-line advertising dried-up. Additionally, high-speed internet access rapidly overtook AOL’s now outdated dial-up offering. Subsequently, in 2009, Time Warner discarded AOL to become a separate company again. This ill-fated merger has become standard case study, as the worst merger ever, for today’s business schools.

[/one_half_last]

Rupert Murdoch – MySpace

[divider]

[one_half]

[/one_half][one_half_last]

MySpace was actually the first social network, preceding Facebook, Twitter, LinkedIn and even YouTube, even registering over one million users in its first month of operation in 2004, in a very similar way to its eventual successors, becoming the fifth largest internet domain in the US. However, along came new owner Rupert Murdoch came along, buying the company for $580 million in 2005, and attempted to make even more millions by over-doing the advertising on-site. This one mistake lead to subscribers exiting in droves, to the aforementioned rivals with far less advertising. MySpace traffic actually peaked in 2008 with almost 80 million visitors, but then declined very rapidly, such that Murdoch sold it for $35 million in 2011. He even had the grace to use Twitter in admitting that “we screwed up in every way possible, learned lots of valuable expensive lessons”.

[/one_half_last]

J.C. Penney – ‘Fake Prices’

[divider]

[one_half]

[/one_half][one_half_last]

Everyone has wondered, when shopping in the seeming plethora of retail ‘sales’ these days, what the real price of an article is. In 2012 the more than 100 year-old department store J.C. Penney’s newly appointed CEO Ron Johnson decided to ‘tell it like it is’, in an attempt to win back business from the likes of Wal-Mart, was to upgrade the stores, and do away with sales and coupons and advertise products at ‘everyday low prices’. Unfortunately, customers who had remained loyal to J.C. didn’t take to this psychology: apparently they liked the old system of believing that they were getting bargains at sale-reduced prices, and missed the ‘sales’ and coupons too. Internet complaints sky-rocketed, sales fell, and the old way of marketing was resumed. CEO Johnson left after just 17 months, and Sergio Zyman – the man who had set Coca-Cola right – was hired to restore customers faith in the old firm.

[/one_half_last]

The post World’s Worst Business Decisions appeared first on Net Worth Post.

Leave a Reply